Hey {{first_name | there}},

The tech giants’ AI race doesn’t seem to be slowing down.

But it also doesn’t seem to be going the way OpenAI expected.

Every few weeks there’s a new launch, a new “most advanced” model, a new benchmark win.

And yet, despite all that, OpenAI is starting to lose something far more important than charts.

Users.

When the “Best Model” Ends Up at #15

Recently, GPT-5.2-High dropped to around #15 on LMArena, a platform where users compare AI answers and vote for the one they prefer.

GPT-5.2 was behind both Claude Opus 4.5 and Gemini-3-Flash.

For a model positioned as OpenAI’s most advanced release, people found this embarrassing.

Not because GPT-5.2 lacks anything. But because it feels bad to use.

Users repeatedly complained that it refuses harmless requests, overreacts to normal prompts, lectures instead of helping, and behaves inconsistently. The same question might work today and get blocked tomorrow.

And LMArena doesn’t care about internal reasoning scores.

It rewards which answer would you actually want to continue working with?

Right now, many users don’t want to continue with GPT-5.2.

OpenAI Is Focusing on Images Now

Just days after, OpenAI moved attention to something else: images.

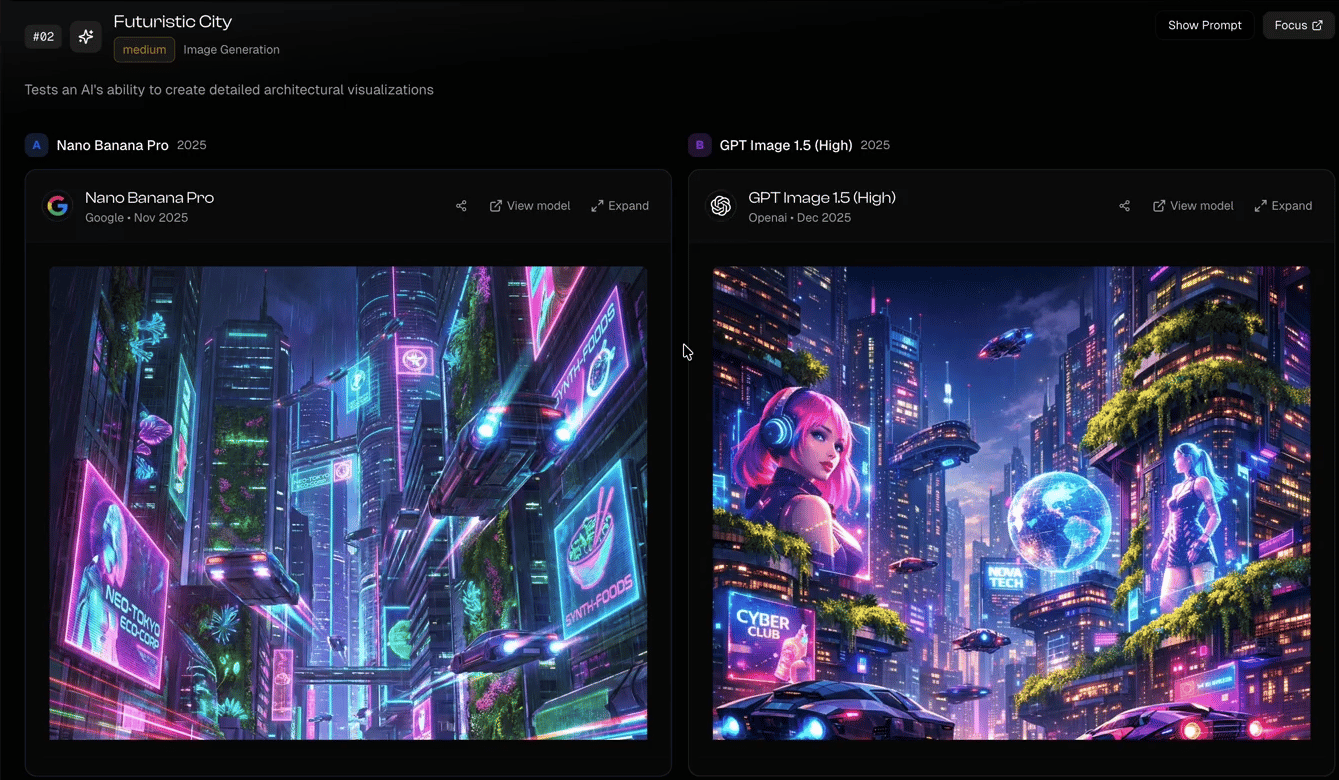

They released GPT Image 1.5, promising faster generation, more accurate edits, and better visual consistency. The timing wasn’t subtle. Google’s Nano Banana had already driven massive sign-ups.

At the same time, Google is pushing Gemini 3 Flash, positioning it as the fast, cheap, default option across the Gemini app and Search.

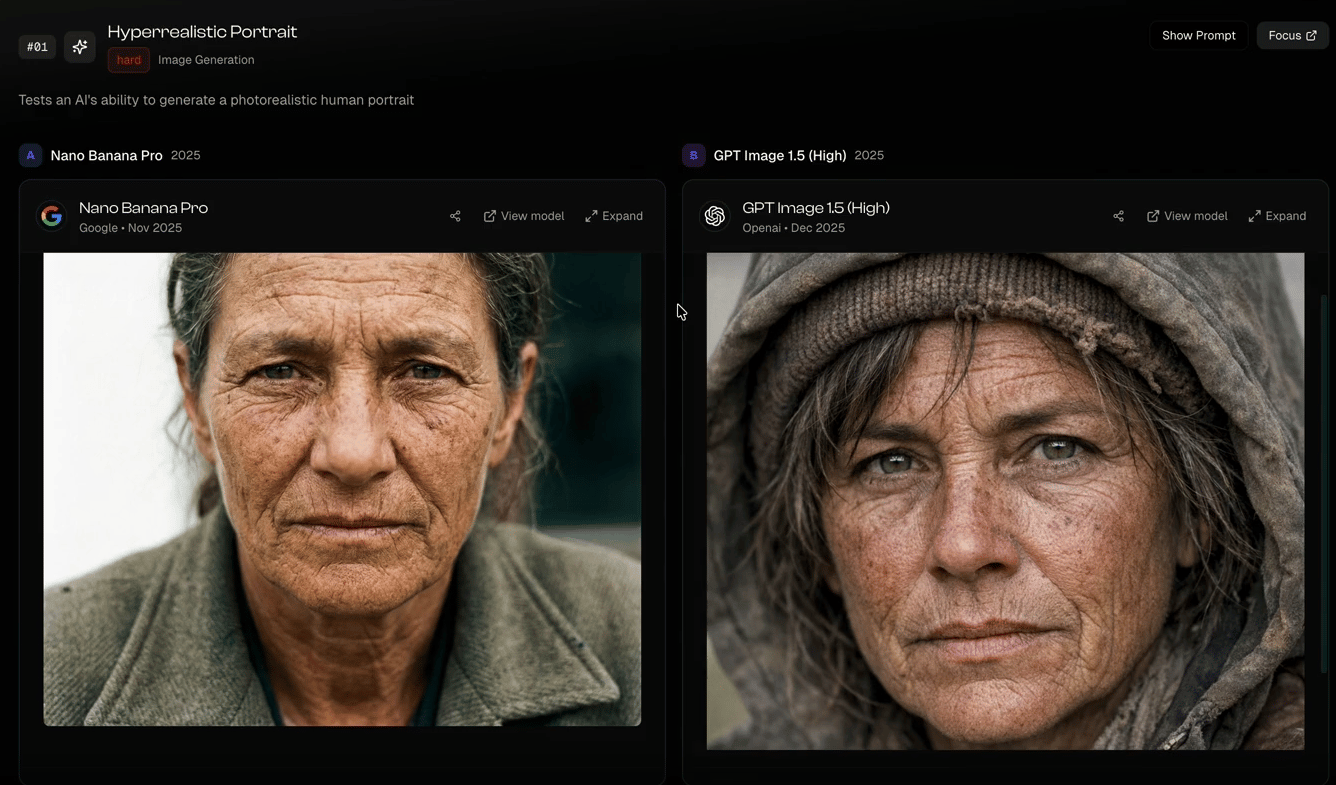

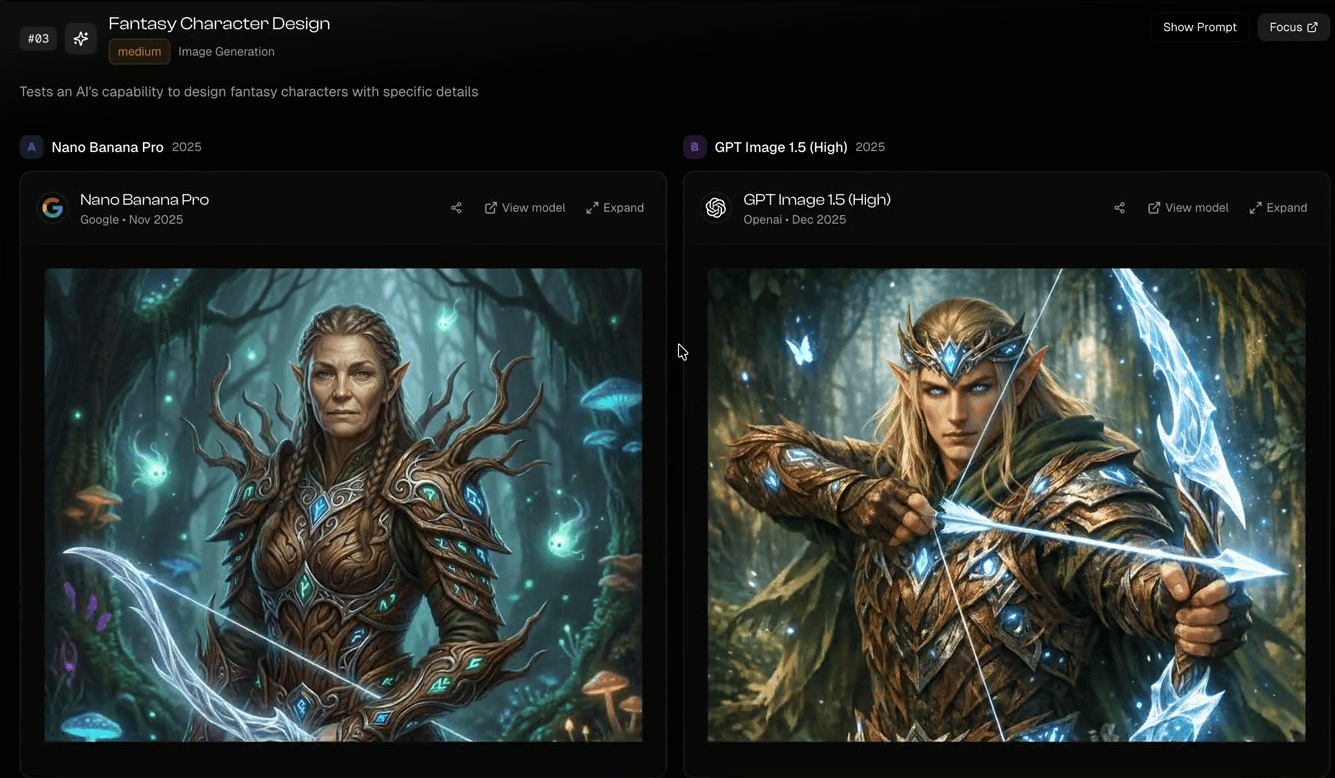

To see how real this competition is, some users compared GPT Image 1.5 and Gemini 3 Flash’s outputs using the exact same prompt.

OpenAI focused on precision, controlled edits, and consistency across iterations.

Google focused on speed and output that was “good enough” immediately.

That difference explains a lot about how each company is thinking right now.

Meta Did Something Different Altogether

While OpenAI and Google were busy reacting to each other, Meta released SAM Audio.

A tool that can isolate any sound from complex audio using text, visuals, or selection. Something creators and developers couldn’t do before.

This is important because it highlights a shift happening across AI.

The race is no longer about who has the smartest model.

It’s about who removes the most friction from real work.

CEOs Are Still Burning Cash on AI, Out of Fear

Despite everything, the spending hasn’t slowed at all.

A recent survey of over 350 public-company CEOs found that 68% plan to increase AI spending in 2026.

Here’s the catch.

Fewer than 10% of AI pilot programs have produced real revenue gains.

Most companies are pouring money into AI, not because it’s paying off, but because they’re afraid of what happens if they stop.

No CEO wants to be the one who “missed AI” or got “left behind”.

So budgets keep growing. Pilots keep running. Results are expected “eventually.”

This is FOMO at an enterprise scale.

This Is Exactly What Bill Gates Was Warning About

Recently, Bill Gates said something that fits this moment perfectly.

He warned that many AI companies are overvalued, and that a “reasonable percentage” of them won’t be worth that much in the long run.

Importantly, he wasn’t saying AI is a bubble.

He said AI is real, but not every AI investment will justify its valuation.

What we’re seeing now is that mismatch in real time.

That gap, between belief and actual value, is the correction Gates was talking about.

The AI race isn’t ending.

But the assumption that “more advanced” automatically means “more valuable” is already breaking.

And the people who recognise that early users, builders, and companies will waste far less time and money chasing tools that look impressive but don’t earn their place.

What do you think, are we already inside the AI correction, or is the hardest part still ahead?

- Aashish

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 25 sales have delivered net annualized returns like 14.6%, 17.6%, and 17.8%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd